Each organisation in the UK carries out Capex (Capital Expenditure) planning exercise every year. Together with Opex (Operational Expenditure), and Revenue Expenditure, Capex becomes a majority of the budget planning activities depending on organisations strategic objectives.

What is Capital Expenditure?

Capital expenditures are funds to purchase, maintain or upgrade assets e.g. infrastructure, equipment, digital transformation etc.

Spread the Capex outlay over a few years and allocate investments towards the organization’s growth or the optimization of existing assets.

Factors to consider for Capex

There are multiple factors considered when deciding on Capex investments.

- Define what is success, benefits, and outcomes from the multi-year investment

- Multiple top-down and bottom-up plans for break-even point

- Finance and Resource plans, Vendor selections etc.

- What-if scenarios including governance, risk and resilience, legal and compliance

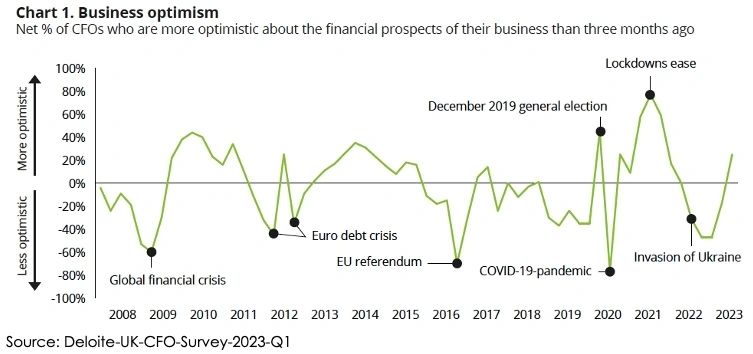

- Internal and external factors including the global geo-political situations (see fig.1 – Business Optimism).

- Selection and prioritisation of key strategic projects that generate value

- Risks, Assumptions, Issues, Dependencies and Decisions that impact

- Lines of communication with CEO, CIO, COO, Directors etc.

After an exhaustive planning exercise and multiple iterations the office of the CFO signs off the Capex plans.

Dealing with Capex Budgets

The CFO’s office tracks and measures the budgets approved for returns of the investment are per the plan and reconciliation of the investments.

There are different by which the CFO’s office, in conjunction with COO and CIO etc. identify a shortlist of the items for adoption are as below:

- Utilisation of best practices in vendor selection process

- Creating MVP (minimum viable product)

- Book of work to manage the delivery by splitting into multiple projects

- Deployment of appropriate tools and utilities for on-demand value-driven reports

- Programme /project report tracking

- Risk mitigation and alternative, fallback options

- Measuring investment vs returns quarterly, half-yearly and yearly basis

The result of Capex can be multi-fold and can cause potential challenges if not handled well.

The upside to Capex is going to deliver a transformative change required for the organisation’s growth and can put them into a higher orbit. If not managed well could result in unnecessary strain on the organisation and may impact other critical areas which were put on low priority. Capex Planning capital expenditure budget example.

Refer to the pages on CFO and Financial Planning & Analysis from our website.